Medicare Parts A, B, C & D Explained: Which One Do You Need?

Navigating through Medicare can be confusing with its various parts and coverage options. If you’re nearing retirement or are already eligible, it’s essential to understand what each part of Medicare offers and how it fits into your healthcare needs.

In this article, we’ll dive into Medicare Parts A, B, C, and D, explaining the differences and how to determine which plan might be right for you. Let’s get started with a breakdown of Medicare Parts A, B, C & D explained.

Understanding the Basics of Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older, but it also covers some younger individuals with disabilities or specific medical conditions. It helps with the cost of healthcare, though it doesn’t cover all healthcare expenses. Below, we’ll dive deeper into the specifics of each Medicare part and how they work together.

What Is Medicare and Who Is Eligible?

Medicare is designed to provide affordable health insurance to seniors and certain individuals under the age of 65 with disabilities. To be eligible, you typically need to be at least 65 years old and either a U.S. citizen or a permanent resident who has lived in the U.S. for at least five years.

How Medicare Works in the U.S. Healthcare System

Medicare plays a significant role in the U.S. healthcare system by helping reduce out-of-pocket costs for senior citizens. It provides coverage for hospital stays, medical services, and prescription medications, though it doesn’t cover all healthcare services. Medicare works in conjunction with other insurance, including employer-based insurance or supplemental plans like Medigap.

![]()

Medicare Part A – Hospital Insurance

Medicare Part A is often called hospital insurance because it primarily helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services.

What Does Medicare Part A Cover?

Part A provides coverage for services related to hospital care, skilled nursing facility care (not custodial or long-term care), hospice care, and some home health services. It’s an essential part of Medicare for those who anticipate needing inpatient care.

Costs and Deductibles for Part A

While many people receive Part A without paying a premium (if they or their spouse paid Medicare taxes for a certain amount of time), there are still deductibles and coinsurance. For instance, in 2023, if you’re admitted to the hospital, you might pay a deductible and daily coinsurance for extended stays.

Who Qualifies for Premium-Free Part A?

You may qualify for premium-free Part A if you or your spouse paid Medicare taxes for at least 10 years. If not, you may still be able to purchase Part A, but you’ll have to pay monthly premiums.

Medicare Part B – Medical Insurance

Part B covers outpatient medical services, including doctor’s visits, lab tests, durable medical equipment, and other services not covered under Part A.

What Services Does Part B Cover?

Part B covers a broad range of services like physician services, outpatient hospital services, and some preventive services, such as screenings, vaccines, and wellness visits.

Medicare Part B Costs and Premiums

Most individuals will pay a monthly premium for Part B, with the amount varying depending on income. There are also deductibles and coinsurance that may apply.

Do You Need Both Part A and Part B?

In many cases, enrolling in both Medicare Part A and Part B is necessary to ensure you receive comprehensive coverage for hospital stays and outpatient services.

Medicare Part C – Medicare Advantage Plans

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B). It bundles these parts together with additional benefits, often including vision, dental, and prescription drug coverage.

How Medicare Advantage (Part C) Works

Medicare Advantage plans are offered by private insurance companies and are required to cover everything that Original Medicare does. However, these plans may offer extra benefits, which can vary based on the provider.

Differences Between Original Medicare and Medicare Advantage

One key difference is that Medicare Advantage plans often have lower out-of-pocket costs but come with a network of doctors and hospitals. Unlike Original Medicare, which provides nationwide coverage, Medicare Advantage is usually more restricted geographically.

Pros and Cons of Choosing Medicare Part C

The advantage of Medicare Advantage is the additional benefits, such as prescription drug coverage and dental, that aren’t available with Original Medicare. However, these plans may limit your choices for healthcare providers and may require referrals for specialists.

Medicare Part D – Prescription Drug Coverage

Part D is designed to help cover the cost of prescription medications. This coverage is provided through private insurance companies approved by Medicare.

What Drugs Are Covered Under Part D?

Part D plans cover a wide range of prescription medications, from generic drugs to brand-name ones. The specific drugs covered depend on the plan you choose.

How to Enroll in a Medicare Part D Plan

To enroll in Part D, you’ll need to choose a stand-alone prescription drug plan or enroll in a Medicare Advantage plan that includes prescription drug coverage. Enrollment typically happens during your Initial Enrollment Period or during the Annual Election Period.

Understanding the Medicare Part D Donut Hole

The Part D donut hole refers to a gap in prescription drug coverage, which can result in higher out-of-pocket costs for medications. However, there are discounts and assistance programs available to help with this coverage gap.

Comparing Medicare Parts A, B, C & D

Choosing the right Medicare plan for you can be overwhelming. Understanding the differences between Medicare Parts A, B, C & D explained will help guide your decision. Let’s compare them and help you determine which one fits your needs.

Which Medicare Plan Is Right for You?

The best plan depends on your healthcare needs and financial situation. For those who need prescription drug coverage, Part D is a must. If you prefer a more streamlined plan with extra benefits, Part C may be ideal.

Can You Have Medicare Advantage and Part D?

If you have a Medicare Advantage plan, it may already include Part D coverage, so you typically wouldn’t need a separate Part D plan.

Supplementing Medicare with Medigap Plans

Medigap, or Medicare Supplement Insurance, can help cover out-of-pocket expenses not covered by Original Medicare (Parts A and B). This may include copayments, coinsurance, and deductibles.

How to Enroll in Medicare and Choose the Right Plan

Enrolling in Medicare can be done online through the official Medicare website, over the phone, or in person at your local Social Security office.

When to Sign Up for Medicare

You should sign up for Medicare when you first become eligible, typically at age 65. There are specific windows for enrollment, so understanding these timelines is essential to avoid late penalties.

Avoiding Late Enrollment Penalties

If you delay signing up for Medicare without having creditable insurance, you may face late enrollment penalties, which could increase your premiums.

Getting Help from a Medicare Insurance Agent

If you feel overwhelmed by the choices, a Medicare insurance agent can help you navigate the different plans and find the one that best suits your needs.

Final Thoughts – Making the Right Medicare Choice

Choosing the right Medicare plan can significantly impact your healthcare coverage and costs. With Medicare Parts A, B, C, and D explained, you can make an informed decision about what’s best for your health and budget.

Key Takeaways for Choosing the Right Medicare Plan

It’s essential to understand what each Medicare part covers, whether you need additional coverage through Part C or D, and if you can benefit from Medigap. By comparing these options, you’ll be able to find the right fit for you.

Where to Get Help Understanding Medicare

For further assistance, consider speaking with a Medicare advisor or using online resources to ensure you fully understand your options before making a decision.

Making Informed Medicare Decisions

Choosing the right Medicare plan is crucial to managing your healthcare needs and costs. By understanding the details of Medicare Parts A, B, C, and D explained, you can make an informed decision that aligns with your health and financial goals. Consider seeking expert advice to ensure the best coverage.

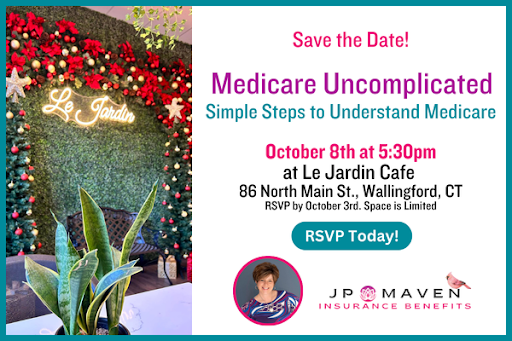

Need help choosing the right Medicare plan? Contact us at JP Maven Insurance Benefits for expert guidance and personalized support. We’re here to help you navigate your Medicare options!