Are Medicare Premiums Tax Deductible?

A lot of seniors raise a very important issue as tax season approaches: Can I deduct my Medicare premiums from my taxes? Americans are looking for every way to save money since health care expenses are going up, and homeowners’ insurance is getting tougher about what it expects of families. Medicare covers more than 65 million individuals, and for a lot of them, the premiums are a big cost.

Medicare Premiums and Tax Deductibility

If taxpayers list their deductions and their medical costs are more than 7.5 percent of their adjusted gross income, they can deduct them from their taxes. This rule also applies to Medicare premiums. If you pay for Part B, Part D, or even a Medicare Advantage plan, those costs may be able to be deducted from your taxes. For retirees, this can imply thousands of dollars in possible deductions each year, but only if their total medical costs go over 7.5 percent.

Understanding the Details

Costs associated with Medicare are not all the same. For example, most people can’t deduct their Part A premiums because most beneficiaries don’t pay them. But if you do pay for Part A, such as when you have less than 40 quarters of Social Security credits, you can deduct those costs. You can also deduct the premiums you pay for Medigap supplemental insurance.

According to the IRS, only around 11% of taxpayers itemize their deductions in a given year. This indicates that only a small number of people benefit from these rules. It can still make a big difference for individuals who qualify.

The Bigger Financial Picture

This talk about Medicare premiums being tax-deductible is part of a bigger tale. Prices are going up from all sides, which is making life hard for seniors and homeowners. AARP said in 2021 that the average

person on Medicare paid more than $6,000 a year in premiums and other costs that weren’t covered by Medicare. Homeowners’ insurance rates are also going up a lot in many states.

For example, rates in Florida went up by more than 40% in two years, while in California, a number of big insurance companies have ceased writing new homeowner policies altogether because of the risk of wildfires. Just like insurance companies are asking more from homeowners, seniors are seeing their healthcare bills go up, which is making many of them look for ways to save money through tax deductions.

Conclusion

So, can you deduct your Medicare premiums from your taxes? Yes, but only if you list your deductions and your medical costs are more than 7.5% of your income. Part B, Part D, Medicare Advantage, and even Medigap policy premiums can all add up to that amount. For a lot of older people, this is a method to make the rising cost of healthcare less painful.

But the bigger picture is clear: Americans are under more and more stress from both health insurance and homeowners’ insurance. It’s important to know your advantages, look into deductions, and get professional help to be ready. Call JP Maven Insurance immediately to get additional useful information that will keep your house and health safe.

Remember, people don’t stress when they call Jess!

This is a solicitation for insurance. Not affiliated with the U. S. government or federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

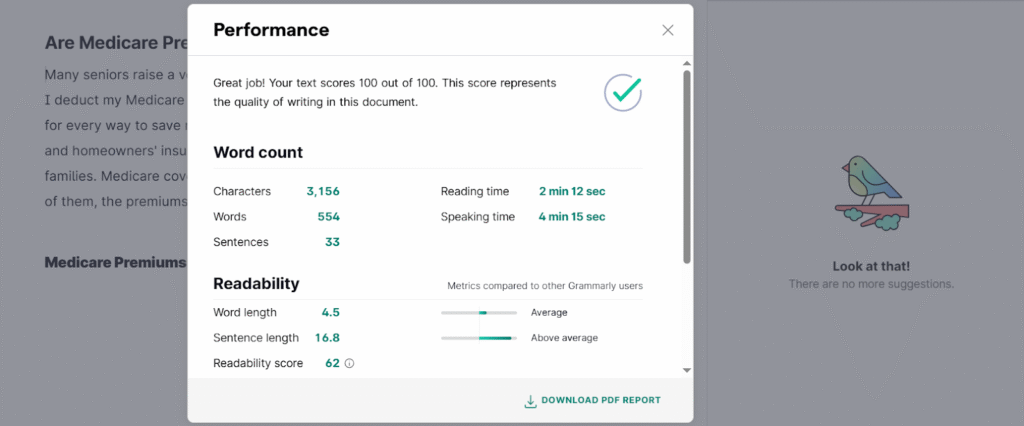

Grammarly Premium Report

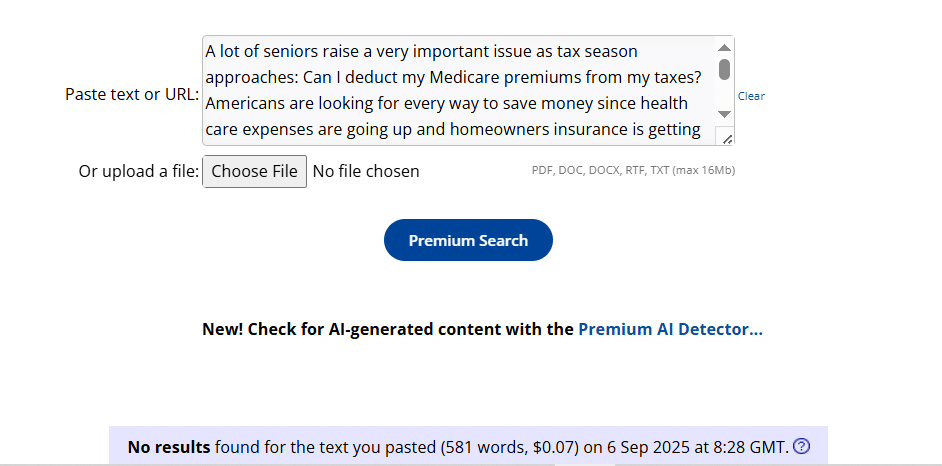

Copyscape Premium Report

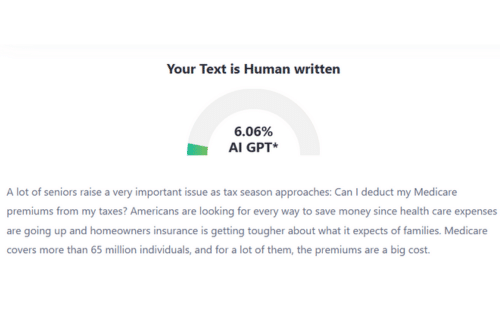

AI Content Detection Report