What Part D Plans Go with Original Medicare for Seniors? Your Guide to Prescription Drug Coverage

Navigating Medicare can feel like a maze, especially when it comes to prescription drug coverage. If you’re a senior enrolled in Original Medicare, you may be wondering how to get help with the cost of your medications. The answer lies in Medicare Part D.

In this guide, we’ll break down what Part D is, why it’s essential, and how to choose the best plan for your needs.

Understanding Medicare Part D

What Is Medicare Part D?

Medicare Part D is a federal program that helps cover the cost of prescription drugs. It’s offered through private insurance companies approved by Medicare. You can purchase a standalone Part D plan if you have Original Medicare (Part A and Part B), or you might get drug coverage through a Medicare Advantage plan that includes it.

Why It’s Important for Seniors on Original Medicare

Original Medicare does a good job of covering hospital and outpatient services, but it doesn’t cover most prescription medications. For many seniors, especially those on fixed incomes, medication costs can add up quickly. That’s why Part D is so important — it offers protection from the high cost of prescriptions.

What Part D Covers (and What It Doesn’t)

Part D covers a wide range of medications, including many brand-name and generic drugs. Plans are required to cover drugs in all therapeutic categories, but the specific drugs and costs vary by plan. However, Part D does not cover over-the-counter medications, vitamins, or drugs not listed on a plan’s formulary.

Why You Need a Part D Plan with Original Medicare

Original Medicare Doesn’t Include Drug Coverage

One of the most common misconceptions is that Medicare includes drug coverage — it doesn’t. Without a Part D plan, you’ll be responsible for paying the full cost of your prescriptions out-of-pocket. That can be a major financial burden, especially if you have chronic conditions that require ongoing medication.

Avoiding Penalties for Late Enrollment

If you don’t enroll in a Part D plan when you’re first eligible and you don’t have other credible drug coverage, you could face a late enrollment penalty. This penalty is added to your monthly premium and lasts for as long as you have Part D coverage. Enrolling on time helps you avoid this unnecessary cost.

Managing Prescription Drug Costs

Even with coverage, prescription drugs can be expensive. Part D plans help reduce these costs through negotiated prices, preferred pharmacy networks, and tiered drug pricing. Having the right plan can significantly lower what you pay out of pocket.

How Part D Plans Work with Original Medicare

Standalone Prescription Drug Plans (PDPs)

If you have Original Medicare, you’ll likely enroll in a standalone Prescription Drug Plan (PDP). These plans are separate from your Medicare Parts A and B, but they work together to give you more comprehensive coverage.

Who Can Enroll in a Part D Plan

Anyone who is eligible for Medicare Part A and/or Part B can enroll in a Part D plan. You must live in the service area of the plan you choose. There’s no health screening, so even if you have pre-existing conditions, you can still sign up.

When You Can Enroll or Switch

You can enroll in a Part D plan during your Initial Enrollment Period (IEP), which starts three months before the month you turn 65 and ends three months after. Each year, there’s also an Annual Enrollment Period (October 15 to December 7) when you can switch plans. There are also Special Enrollment Periods for specific life changes, like moving or losing other coverage.

Choosing the Right Part D Plan for Your Needs

Things to Consider: Medications, Pharmacy Network Costs

Not all Part D plans are created equal. Some may offer better coverage for the medications you take, while others might have lower costs at your preferred pharmacy. Key factors to consider include the plan’s formulary (drug list), premium, deductible, and copayments.

Comparing Plans in Your Area

Since Part D plans vary by location, it’s important to compare the ones available in your ZIP code. Differences in pricing, pharmacy networks, and coverage can be significant — even between plans offered by the same company.

Using the Medicare Plan Finder Tool

The Medicare Plan Finder tool on Medicare.gov is a great starting point. It allows you to enter your prescriptions and preferred pharmacies to see which plans offer the best value for your situation.

What’s the Best Part D Plan for Seniors?

Popular Provider Plan Options

Many insurance companies are Part D providers. They offer a range of plans with different levels of coverage, networks, and costs.

High vs. Low Deductible Plans

Low-premium, high-deductible plans can be a good choice for seniors who don’t take many medications. If you have multiple prescriptions, a plan with a higher premium but lower out-of-pocket costs might save you money overall.

Which Plans Cover Tier 1, 2, and 3 Drugs Well?

Drugs in Tier 1 (generics) and Tier 2 (preferred brands) are typically covered at lower costs. Tier 3 drugs can be more expensive. Look for plans that offer strong coverage for the specific tiers your medications fall into. It’s also important to check if your prescriptions require prior authorization or step therapy.

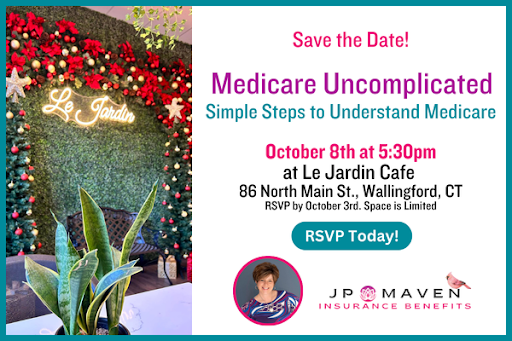

How JP Maven Insurance Helps You Find the Right Plan

Personalized Help from a Licensed Medicare Agent

At JP Maven Insurance, we understand that Medicare can be confusing. Our licensed agents offer one-on-one guidance tailored to your health needs, medication list, and budget — all at no cost to you.

Comparing Plans Without the Stress

We do the heavy lifting for you — comparing multiple Part D plans, explaining the pros and cons, and helping you avoid common pitfalls. Our goal is to simplify the process and ensure you don’t overpay for coverage.

Local Expertise, National Reach

Whether you’re in a rural area or a major city, our agents know the local healthcare landscape and can help you find plans that include your doctors, pharmacies, and medications — no matter where you live.

FAQs About Medicare Part D

Can I use Part D with Medigap?

Yes! Medigap policies (Medicare Supplement Insurance) help pay for costs not covered by Original Medicare, like deductibles and copays — but they don’t include drug coverage. That’s why pairing a Medigap plan with a standalone Part D plan is a common and effective strategy.

What if I have VA drug coverage or retiree benefits?

If you already have credible drug coverage through the VA or an employer retiree plan, you may not need Part D. However, it’s important to compare costs and coverage. You can still enroll in Part D later without penalty if your current plan is considered credible coverage.

What happens if I skip Part D when I first enroll?

If you go without drug coverage for 63 days or more after your initial eligibility period and then enroll later, you’ll likely face a late enrollment penalty. This penalty is added to your Part D premium and stays with you as long as you have coverage.

Work with Someone You Trust — JP Maven Insurance Benefits

At JP Maven Insurance, we’re committed to helping seniors make confident, informed choices. We bring clarity to your Medicare journey, making it easier to get the coverage you need and the peace of mind you deserve. Contact us today!